Overview

Doc version 1.22 | Edit on GitHub

The Payments protocol provides a payment processing solutions that helps you accept payments in fast and secure way. The protocol gives your customers flexibility to pay the way they want, including:

- Debit or credit cards, like Visa, Mastercard, and Mir.

- QIWI Wallet.

- Faster Payments Systems (SBP).

- Mobile phone account.

Terms and Abbreviations

API Key — String for merchant authorization in API according to OAuth 2.0 standard RFC 6749 RFC 6750.

Payment token — String linked to the card data for payments without entering card details.

API: Application Programming Interface — a set of ready-made methods provided by the application (system) for use in external software products.

REST: Representational State Transfer — a software architectural pattern for Network Interaction between distributed application components.

JSON: JavaScript Object Notation — a lightweight data-interchange format based on JavaScript RFC 7159.

3DS: 3-D Secure — protection protocol to authenticate card holder while making a payment transaction over the Internet. QIWI supports both 3DS 1.0 version and 3DS 2.0 version of the protocol.

RSP, Merchant — Retail Service Provider.

MPI: Merchant Plug-In — programming module performing 3DS customer authentication.

PCI DSS: Payment Card Industry Data Security Standard – a proprietary information security standard for storing, processing and transmitting credit card data established by Visa, MasterCard, American Express, JCB, and Discover.

How to Get Started

To start using Protocol, you need to complete the following steps.

Step 1. Leave request to integrate on b2b.qiwi.com

After processing the requests, our personnel contact you to discuss possible ways of integration, collect the necessary documents and start integration process.

Step 2. Get access to your Account

Upon connecting to the Payment Protocol, we provide you the unique site identifier (siteId) and access to your Account in our system. We send the Account credentials to your e-mail address specified on registration.

Step 3. Issue API access key for the integration

API access key is used for interaction with API. Issue API access key in Settings section of your Account.

Step 4. Test the interaction

During integration process, your siteId identifier is in test mode. You can proceed test operations without debiting credit card. See Test and Production Mode for details.

When integration on your side is completed, we turn your siteId to production mode. In the production mode cards are debited.

Ways of Integration

Payment protocol provides several ways of integration:

Available Payment Methods

| Method | Payment through QIWI Form | Payment through merchant form |

|---|---|---|

| Credit/debit card* | ✓ | ✓** |

| Payment by payment token | ✓ | ✓ |

| Faster Payments System | ✓ | ✓ |

| QIWI Wallet Balance | ✓ | ✓*** |

| Mobile phone account | × | ✓ |

* — default payment method, other methods are available upon request.

** — PCI DSS certification is required.

*** — by issuing a payment token for QIWI wallet

Operation Types

The following operations are available in the protocol:

- An Invoice — an electronic document that the merchant has issued to the customer. Contains information about the amount and number of the customer order. It is not a financial entity and has a limited lifespan. Billing is required to obtain a URL to the QIWI payment form.

- Payment — a cash write-off transaction from the customer in favour of the merchant. The actual write-off occurs only after confirmation (see Capture). When working through the QIWI payment form, Payment is an attempt to pay the bill (see Invoice).

- Complete — the completion of 3DS verification of the customer. It is used when working through the Merchant Payment Form.

- Confirmation (Capture) — confirmation of authorization (charging) of the funds. Only single successful payment confirmation is possible.

- Refund — refund to the customer on a successful payment. Financial operation of debiting money from the merchant in favor of the customer. If there was no confirmation for Payment operation, you will receive the Reversal flag in the response to Refund operation request and the money from the customer's account will not be transferred to the Merchant's account (the acquiring fee is also not withheld).

Payment processing and settlements scheme

Merchant participant qb as QIWI participant ips as Payment system participant ipscust as Bank of

Customer

Issuer or bank-sender customer->>store:Payment start store->>qb:Payment operation qb->>ips:Payment authorization ips->>ipscust:Payment authorization rect rgb(255, 238, 223) Note over ipsstore, ipscust:Settlements ipscust->>ips:₽₽₽ ips->>qb:₽₽₽ qb->>ipsstore:₽₽₽ end

Interaction format

The Payment protocol API is built on the REST architecture, where data and methods are considered as resources accessed via calling Uniform Resource Identifiers (URIs).

API uses HTTPS-requests for calling its methods. API endpoint has URL:

https://api.qiwi.com/partner/

API requests' parameters are transferred as the request body JSON data. Parameters in HTTP GET-requests are placed in URL query.

It is necessary to put Accept: application/json header into the request headers as API always responds in JSON format.

The API methods provide logical idempotence, i. e. repeating a method multiple times is equivalent to doing it once. However, the response may change (for example, the state of an invoice may change between requests).

Authorization

Request with authorization

curl -X PUT \

https://api.qiwi.com/partner/v1/sites/{site_id}/payments/{payment_id} \

--oauth2-bearer <API Key>

Authorization header

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

For the requests authorization OAuth 2.0 standard is used in accordance with RFC 6750. Always put API access key value into Authorization HTTP-header as

Bearer <API Key>

How to Test Operations

During integration, your siteId identifier is in test mode. You can proceed operations without debiting credit card. You can also request a switch to test mode for any of your siteId, or add a new siteId to test mode through your manager in QIWI Support.

For testing purposes, the same protocol URLs are used.

Test mode is not supported for QIWI Wallet balance payments.

You don't need to re-release the API access key when you go into the production mode.

If necessary, change the permanent URL for notifications from a test notification (such as https://your-shop-test.ru/callbacks) to a production one (such as https://your-shop-prod.ru/callbacks) in your Account Profile.

Card payment

To test various payment methods and responses, use different expiry dates:

| Month of card expiry date | Result |

|---|---|

02 |

Operation is treated as unsuccessful |

03 |

Operation is processed successfully with 3 seconds timeout |

04 |

Operation is processed unsuccessfully with 3 seconds timeout |

| All other values | Operation is treated as successful |

CVV in testing mode may be arbitrary (any 3 digits).

You can also check payment token issue. Issue scheme in the test mode is the same as in production mode. It is described in Card payment token issue section.

Test card numbers

- Mir:

2200000000000004,2200000000000012,2200000000000020,2200000000000038,2200000000000046,2200000000000053,2200000000000061,2200000000000079,2200000000000087,2200000000000095,2200000000000103,2200000000000111 - Visa:

4256000000000003,4256000000000011,4256000000000029,4256000000000037,4256000000000045,4256000000000052,4256000000000060,4256000000000078,4256000000000086,4256000000000094,4256000000000102,4256000000000110 - Mastercard:

5236000000000005,5236000000000013,5236000000000021,5236000000000039,5236000000000047,5236000000000054,5236000000000062,5236000000000088,5236000000000096,5236000000000104,5236000000000112,5236000000000120 - UnionPay:

6056000000000000,6056000000000018,6056000000000026,6056000000000034,6056000000000042,6056000000000059,6056000000000067,6056000000000075,6056000000000083,6056000000000091,6056000000000109,6056000000000117

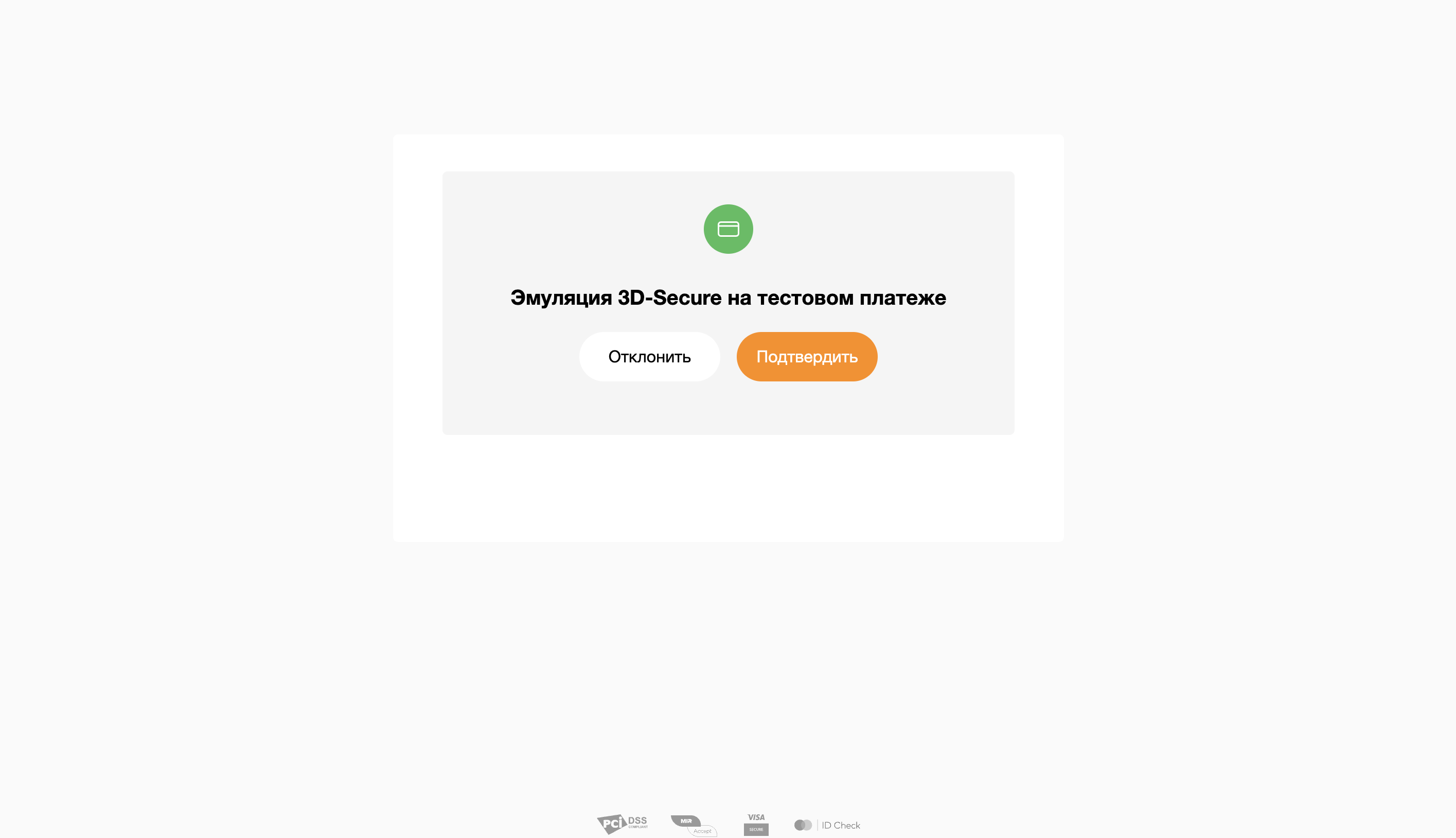

Test 3-D Secure operations

- Create a payment link via API, or without it.

- Use any card from Test Card Numbers list.

- For 3-D Secure in test mode CVV should be

849or use a cardholder name that contains the string3ds. - Confirm or reject the transaction on the form.

Test limits

- You may use only Russian ruble (

643code) for the currency (amount.currency). -

Restrictions on the amount and number of operations:

- Maximum allowed amount of a single transaction is 10 rubles.

- Maximum number of transactions is 100 per day. All transactions within the current day (by Moscow timezone) with each transaction' amount not more than 10 rubles are taken into account.

Payment through Faster Payments System

In test mode, you can use only QR-code issue and its status request. To test various responses, use different payment amounts (amount.value field):

200— QR-code is successfully created.- For any other amounts the payment would be unsuccessful with

DECLINEDstatus.

When requesting FPS payment status in the test mode the following statuses are returned:

CREATED— Payment created.DECLINED— Payment declined.EXPIRED— Payment QR-code lifetime is expired.

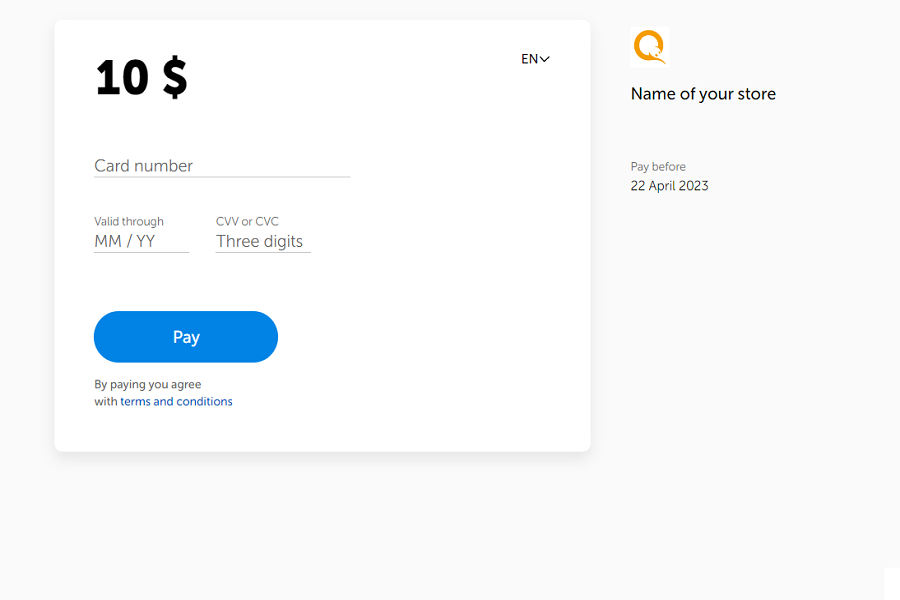

Payment Through QIWI Form

When you integrate payments through the QIWI form, the only available payment method is by bank cards. The following payment methods are enabled on demand:

- Card payment token.

- Faster Payments System.

- QIWI Wallet.

To create invoice for a payment, use API to issue an invoice or simply redirect customer to the QIWI Form by the direct link with the invoice data.

Payment process

One-step payment — all payment methods

Two-step payment — only cards activate qb qb->>store:Response with QIWI Payment form URL

("payUrl" parameter) store->>customer:Redirecting customer to payUrl customer->>qb:Open Payment form,

choose payment method,

enter details for chosen method qb->>customer:Customer authentication:

3-D Secure for cards customer->>qb:Authentication qb->>ips:Request for funds charging activate ips ips->>qb:Operation status qb->>store:Notification with operation status rect rgb(255, 238, 223) Note over qb, customer: "successUrl" parameter is applied to QIWI Payment form URL qb->>customer: Return to the merchant site on successful payment end store->>qb: Check operation status

API: Payment status request qb->>store: Operation status rect rgb(255, 238, 223) Note over store, ips:Two-step payment store->>qb:Payment confirmation

API: Payment confirmation request qb->>ips:Confirming card charging deactivate ips qb->>store:Notification on payment confirmation store->>qb: Check operation status

API: Payment confirmation status request qb->>store: Operation status end deactivate qb deactivate store

QIWI Payment Form integration without API

For merchants, this is the way to integrate without API methods implementation.

Invoice parameters are included into the Payment Form URL — see examples and parameters list below. When the form is opened, the customer is automatically billed for the order.

When paying an invoice issued this way the payment is authorized without the participation of the merchant. As the two-step payment scheme is used (authorization and confirmation), you need to confirm payment in your Account Profile. By default, the service waits for the payment confirmation in 72 hours. When time is up the payment is confirmed automatically.

GET →

Link to the form with payment amount

https://oplata.qiwi.com/create?publicKey=5nAq6abtyCz4tcDj89e5w7Y5i524LAFmzrsN6bQTQ3ceEvMvCq55ToeErzhvK6rVkQLaCrYUQcYF5QkS8nCrjnPsLQgsLxqrpQgJ7hg2ZHmEHXFjaG8qjvgcep&extras[cf1]=Order_123&extras[cf3]=winnie@pooh.ru&readonly_extras=cf1&comment=some%20comment&amount=100.00

Link to the form without payment amount (it is filled in by the customer)

https://oplata.qiwi.com/create?publicKey=5nAq6abtyCz4tcDj89e5w7Y5i524LAFmzrsN6bQTQ3ceEvMvCq55ToeErzhvK6rVkQLaCrYUQcYF5QkS8nCrjnPsLQgsLxqrpQgJ7hg2ZHmEHXFjaG8qjvgcep&extras[cf1]=Order_123&extras[cf3]=winnie@pooh.ru&readonly_extras=cf1

URL https://oplata.qiwi.com/create?publicKey={key}&{parameter}={value}

Parameters

Invoice parameters put to the URL query.

| Parameter | Description | Type |

|---|---|---|

| publicKey | Required. Merchant identification key. For each siteId the unique key is produced. You can get the key in your Account Profile in Settings section. |

String |

| billId | Unique invoice identifier in the merchant's system. It must be generated on your side with any means. Arbitrary sequence of digits and letters, _ and - symbols as well. If not used, on each URL opening a new invoice is created. |

URL-encoded string String(200) |

| amount | Amount of customer order rounded down to 2 digits (always in rubles) | Number(6.2) |

| currency | Currency code for the purchase. Possible values: RUB, EUR, USD. Default value RUB |

String(3) |

| phone | Customer phone number (international format) | URL-encoded string |

| Customer e-mail | URL-encoded string | |

| comment | Comment to the invoice | URL-encoded string String(255) |

| successUrl | URL for a customer return to the merchant site after the successful payment. URL should be UTF-8 encoded. | URL-encoded string |

| paymentMethod | Payment method suggested to the customer on the QIWI form. Possible values: CARD, SBP, QIWI_WALLET. If the method is not enabled for the merchant, an available method is suggested. By default, CARD. |

String |

| extras[cf1] | Extra field to add any information to invoice data | URL-encoded string |

| extras[cf2] | Extra field to add any information to invoice data | URL-encoded string |

| extras[cf3] | Extra field to add any information to invoice data | URL-encoded string |

| extras[cf4] | Extra field to add any information to invoice data | URL-encoded string |

| extras[cf5] | Extra field to add any information to invoice data | URL-encoded string |

| extras[themeCode] | Extra field with code style of the Payment form | URL-encoded string |

| readonly_extras | List of the extra fields which customer cannot edit on the invoice pay form | String, separator of the field names ,. Example: cf1,cf3 |

By default, the customer is automatically authenticated after the invoice is paid. Authentication is also automatically completed.

API invoice issue and QIWI payment form

Invoice creation when payment is put on hold (two-step payment)

PUT /partner/payin/v1/sites/{siteId}/bills/893794793973 HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"amount": {

"currency": "RUB",

"value": 42.24

},

"billPaymentMethodsType": [

"QIWI_WALLET",

"SBP"

],

"comment": "Spasibo",

"expirationDateTime": "2019-09-13T14:30:00+03:00",

"customFields": {}

}

Notification with paymentId

"payment": {

"type": "PAYMENT",

"paymentId": "824c7744-1650-4836-abaa-842ca7ca8a74", <== paymentId necessary for confirmation

"createdDateTime": "2022-07-27T12:43:35+03:00",

"status": {

"value": "SUCCESS",

"changedDateTime": "2022-07-27T12:43:47+03:00"

},

"amount": {

"value": 1.00,

"currency": "RUB"

},

"paymentMethod": {

"type": "CARD",

"maskedPan": "512391******6871",

"cardHolder": null,

"cardExpireDate": "3/2030"

},

"tokenData": {

"paymentToken": "cc123da5-2fdd-4685-912e-8671597948a3",

"expiredDate": "2030-03-01T00:00:00+03:00"

},

"customFields": {

"cf2": "dva",

"cf1": "1",

"cf4": "4",

"cf3": "tri",

"cf5": "5",

"full_name": "full_name",

"phone": "phone",

"contract_id": "contract_id",

"comment": "test",

"booking_number": "booking_number"

},

"paymentCardInfo": {

"issuingCountry": "643",

"issuingBank": "Tinkoff Bank",

"paymentSystem": "MASTERCARD",

"fundingSource": "UNKNOWN",

"paymentSystemProduct": "TNW|TNW|Mastercard® New World—Immediate Debit|TNW|Mastercard New World-Immediate Debit"

},

"merchantSiteUid": "test-00",

"customer": {

"email": "darta@mail.ru",

"account": "11235813",

"phone": "79850223243"

},

"gatewayData": {

"type": "ACQUIRING",

"eci": "2",

"authCode": "0123342",

"rrn": "001239598011"

},

"billId": "191616216126154",

"flags": [

"AFT"

]

},

"type": "PAYMENT",

"version": "1"

}

Payment confirmation

PUT /partner/payin/v1/sites/{siteId}/payments/804900/captures/bxwd8096 HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

Invoice creation when payment is processed without customer authentication (one-step payment)

PUT /partner/payin/v1/sites/23044/bills/893794793973 HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"amount": {

"currency": "RUB",

"value": 100.00

},

"expirationDateTime": "2018-04-13T14:30:00+03:00",

"flags": [

"SALE"

]

}

The payment protocol supports both a two-step payment with holding funds on the customer's card and a one-step payment without the authentication of the customer.

In two-step payment scenario:

-

Create an invoice using the API request Invoice with parameters:

- The API access key.

- The amount of the invoice (

amount). - The date before which the invoice must be paid (

expirationDateTime). - (optional) Other invoice data:

- Customer data (

customer,address). - Comment on the invoice (

comment). - Other information (

customFields).

- Customer data (

To limit payment methods accessible for the customer on the Payment form, specify them in

billPaymentMethodsTypeAPI parameter. Listed methods should be enabled forsiteIdof the API request. - Redirect the customer to QIWI Payment form using URL from

payUrlparameter of the API response, or use Popup JavaScript library to open the form in a popup window. - Get

paymentIdidentifier of the payment:- From server notification after successful holding of funds.

- From the response to the Invoice payments list request.

- Send API request Payment confirmation with received

paymentIdidentifier. - Wait for the payment confirmation. Either you receive a notification, or send Capture status API request in cycle to get an information about the capture.

The reimbursement is formed only after the payment confirmation.

In one-step payment scenario:

-

Create an invoice using the API request Invoice with parameters:

- The API access key.

- The amount of the invoice (

amount). - The date before which the invoice must be paid (

expirationDateTime). - The flag for one-step scenario

"flags":["SALE"]. - (optional) Other invoice data:

- Customer data (

customer,address). - Comment on the invoice (

comment). - Other information (

customFields).

- Customer data (

To limit payment methods accessible for the customer on the Payment form, specify them in

billPaymentMethodsTypeAPI parameter. Listed mods should be enabled forsiteIdof the API request. - Redirect the customer to QIWI Payment form using URL from

payUrlparameter of the API response, or use Popup JavaScript library to open the form in a popup window. - Wait for the payment completion. Either you receive a notification, or send Invoice status API request in cycle to get an information about the payment.

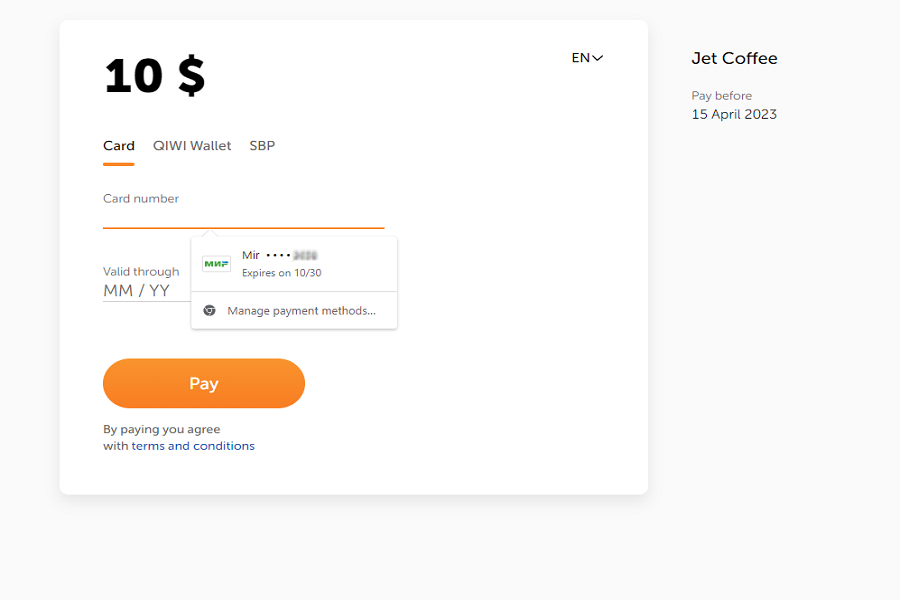

Payment token

Invoice payable with payment token

PUT /partner/payin/v1/sites/test-02/bills/1815 HTTP/1.1

Accept: application/json

Authorization: Bearer 7uc4b25xx93xxx5d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"amount": {

"currency": "RUB",

"value": 100.00

},

"comment": "Text comment",

"expirationDateTime": "2018-04-13T14:30:00+03:00",

"customer": {

"account": "token234"

},

"customFields": {

"cf1": "Some data"

}

}

}

The payment tokens are used for charging a customer balance without entering card details or QIWI Wallet number. By default, the use of payment tokens is disabled. Contact your manager in QIWI Support to enable that.

See details of the issue of a payment token in this section.

To create an invoice payable with payment token, send in API request Invoice the following data:

- API access key.

- Amount of the invoice (

amount). - Last date of payment for the invoice (

expirationDateTime). - Customer identifier for which the payment token was issued, in

customer.accountparameter. Payment by payment token is not possible without this parameter. - Other information about the invoice (

comment,customFields).

Then redirect the customer to QIWI Payment form using URL from payUrl parameter of the API response, or use Popup JavaScript library to open the form in a popup window. If one or more payment tokens have been issued for the customer, the Payment form would display their linked cards.

To use the payment token, the customer chooses a card from the drop-down list. Card data or 3-D Secure authentication is not required.

To charge funds on a payment token without the customer's participation, use the API method Payment. See details in section Using payment token for the merchant's payment form.

Redirect to QIWI Form

Response with payUrl parameter

HTTP/1.1 200 OK

Content-Type: application/json

{

"siteId": "test-01",

"billId": "gg",

"amount": {

"currency": "RUB",

"value": 42.24

},

"status": {

"value": "WAITING",

"changedDateTime": "2019-08-28T16:26:36.835+03:00"

},

"customFields": {},

"comment": "Spasibo",

"creationDateTime": "2019-08-28T16:26:36.835+03:00",

"expirationDateTime": "2019-09-13T14:30:00+03:00",

"payUrl": "https://oplata.qiwi.com/form/?invoice_uid=78d60ca9-7c99-481f-8e51-0100c9012087"

}

After invoice creation in API, the URL of the QIWI Form is taken from payUrl field of the API response.

Example of the URL with "successUrl" parameter

https://oplata.qiwi.com/form?invoiceUid=606a5f75-4f8e-4ce2-b400-967179502275&successUrl=https://example.com/payments/#introduction

You can add the following parameter to the URL:

| Parameter | Description | Type |

|---|---|---|

| successUrl | URL for a customer return to the merchant site after the successful payment. Redirect proceeds after the successful 3DS authentication. URL should be UTF-8 encoded. | URL-encoded string |

| lang | Interface language of the QIWI form. By default, ru |

ru, en |

| paymentMethod | Payment method suggested to the customer on the QIWI form. If the method is not enabled for the merchant, some available method is suggested. By default, CARD. |

CARD, SBP, QIWI_WALLET |

Example of event listener for iframe

window.addEventListener('message', function (event) {

switch (event.data) {

case 'INITIALIZED':

// Form loaded

break;

case 'PAYMENT_ATTEMPT':

// Payment attempt

break;

case 'PAYMENT_SUCCEEDED':

// Payment successful

break;

case 'PAYMENT_FAILED':

// Payment failed

break;

}

}, false)

By default, 3-D Secure is required on the QIWI Form.

When opening URL of the QIWI Form in <iframe>, use additional parameter allow:

<iframe allow="payment" src="<payUrl link> ..." />

You can use postMessage method to listen events in the Form.

Possible values of the Form state:

INITIALIZED— Form loaded.PAYMENT_ATTEMPT— Payment attempt was performed.PAYMENT_SUCCEEDED— Payment successfully processed.PAYMENT_FAILED— Payment failed.INITIALIZATION_FAILED— Error on the Form loading.

Checkout Popup Library

The library helps to use QIWI Payment Form in a popup. It has two methods:

To install the library, add the following script into your web-page:

<script src='https://oplata.qiwi.com/popup/v2.js'></script>

Create invoice

Create new invoice

params = {

publicKey: '5nAq6abtyCz4tcDj89e5w7Y5i524LAFmzrsN6bQTQ3c******',

amount: 10.00,

phone: '79123456789',

email: 'test@example.com',

account: 'account1',

comment: 'Payment',

customFields: {

data: 'data'

},

lifetime: '2022-04-04T1540'

}

QiwiCheckout.createInvoice(params)

.then(data => {

// ...

})

.catch(error => {

// ...

})

To create invoice and open its payment form in a popup, call method QiwiCheckout.createInvoice. Method has the following parameters:

| Parameter | Description | Format |

|---|---|---|

| publicKey | Required. Merchant identification key. For each siteId the unique key is produced. You can get the key in your Account Profile in Settings section. |

String |

| amount | Required. Amount of the invoice rounded down on two decimals | Number(6.2) |

| phone | Phone number of the client to which the invoice is issuing (international format) | String |

| E-mail of the client where the invoice payment link will be sent | String | |

| account | Client identifier in merchant’s system | String |

| comment | Invoice commentary | String(255) |

| customFields | Additional invoice data. Obtain full list of data fields in the description of the same parameter in invoice API request | Object |

| lifetime | Invoice payment’s due date. If the invoice is not paid before that date, it assigns final status and becomes void | URL-encoded string YYYY-MM-DDThhmm |

Open invoice

Open an existing invoice in popup

params = {

payUrl: '<URL of the invoice Pay form>'

}

QiwiCheckout.openInvoice(params)

.then(data => {

// ...

})

.catch(error => {

// ...

})

To open existing invoice payment form in a popup, call method QiwiCheckout.openInvoice. Method has single parameter:

| Parameter | Description | Type |

|---|---|---|

| payUrl | Required. URL of the invoice Pay form | String |

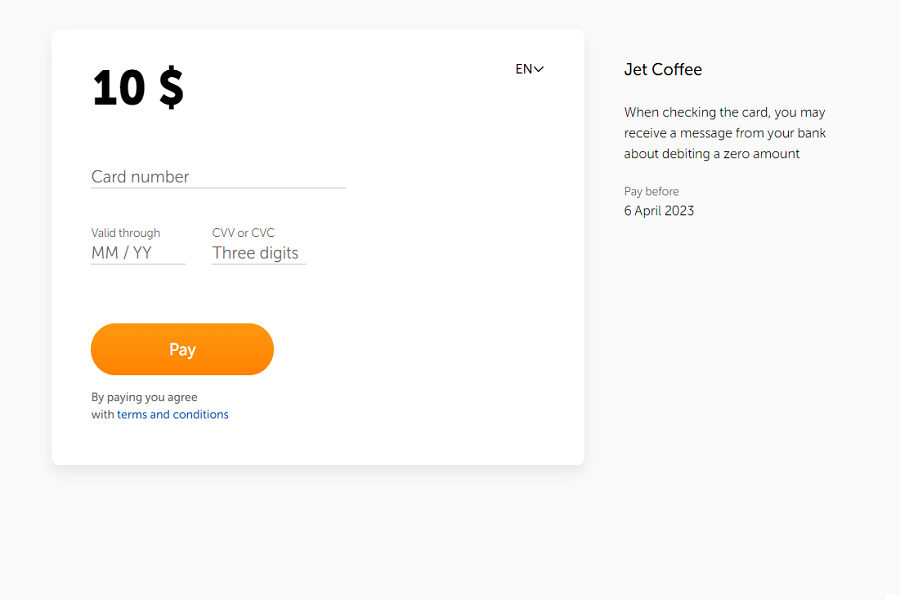

Customization of QIWI Payment Form

Example of calling Custom Payment form

PUT /partner/payin/v1/sites/23044/bills/893794793973 HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"amount": {

"currency": "RUB",

"value": 100.00

},

"comment": "Text comment",

"expirationDateTime": "2018-04-13T14:30:00+03:00",

"customer": {},

"customFields": {

"themeCode":"merchant01-style01"

}

}

Add your style, customizable logo, background, and color of the buttons to the Payment form on the QIWI side. To do so, contact QIWI Support and provide the following information:

- Unique alias for the Payment form (latin letters, digits, and

-dash symbol). - Merchant name to be displayed on the Form.

- Logo in PNG or SVG format with 48x48 size or proportionally larger.

- Color of buttons, in HEX.

Some optional data are also used:

- Offer reference.

To use your Custom Payment form:

-

Send the alias for the Payment form in

"themeCode"field ofcustomFieldsobject of API request Invoice:"themeCode":"merchant01-theme01".URL received in

payUrlfield of the API response points to the Custom Payment form. -

Send the alias for the Payment form in direct call of the form in

extras[themeCode]parameter:...&extras[themeCode]=merchant01-theme01.

Example of the customized Payment form:

Payment Through Merchant Web Form

Bank Card payment method is available for integration by default. The following payment methods are enabled on demand:

Payment process

enter card data activate store store->>qb:API: Payment request

One-step payment — all payment methods

Two-step payment — only cards activate qb qb->>store:Operation status, 3DS data or

QR code for Faster Payment System rect rgb(255, 238, 223) Note over customer, ips:3-D Secure store->>customer:Redirecting customer to acsUrl

or to the bank app (Fast Payments System) activate ips ips->>customer:Customer authentication:

3DS — cards,

Faster Payment System — confirming the operation in the card issuer app customer->>ips:Authentication ips->>store:Result of the authentication (PaRes) store->>qb:API: Completing customer authentication request end qb->>ips:Request for charging funds activate ips ips->>qb:Operation status qb->>store:Notification on the status of the operation store->>qb: Check operation status

API: Payment status request qb->>store: Operation status rect rgb(255, 238, 223) Note over store, ips:Two-step payment store->>qb:API: Payment confirmation request qb->>ips:Confirming card charging deactivate ips qb->>store:Notification on the payment confirmation store->>qb: Check operation status

API: Payment confirmation status request qb->>store: Operation status end deactivate qb deactivate store

To create a payment, send the following data in API request Payment:

- API access key;

- amount of payment;

- payment method;

- other information for payment creation.

Bank card payment

The payment protocol supports both a two-step payment with holding funds on the customer's card, and a one-step payment without the authentication of the customer.

Payment creation

Example of a payment with subsequent funds hold (two-step)

PUT /partner/payin/v1/sites/test-01/payments/1811 HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"amount": {

"currency": "RUB",

"value": 1.00

},

"paymentMethod" : {

"type" : "CARD",

"pan" : "4444443616621049",

"expiryDate" : "12/19",

"cvv2" : "123",

"holderName" : "unknown cardholder"

}

}

Example of a payment with immediate client charging (one-step payment)

PUT /partner/payin/v1/sites/test-01/payments/1811 HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"amount": {

"currency": "RUB",

"value": 1.00

},

"paymentMethod" : {

"type" : "CARD",

"pan" : "4444443616621049",

"expiryDate" : "12/19",

"cvv2" : "123",

"holderName" : "unknown cardholder"

},

"flags": [ "SALE" ]

}

To start payment with subsequent hold of funds on the client card (two-step payment), send the following data in API request Payment:

- API access key;

- payment amount data;

- payment method parameters in

paymentMethodobject:type—CARD;pan— card number;expiryDate– card expiry date inMM/YYformat;cvv2— card CVV2/CVC2;holderName– card holder name (Latin letters);

- other information about the payment.

When the customer card was previously tokenized on your side, the following parameters in paymentMethod should be included:

cardTokenPaymentType– parameter for correct processing of transactions in the payment systems. Allowed values:FIRST_PAYMENT— when you are going to save the card data on your side;INITIATED_BY_CLIENT— transaction on the saved card initiated by a client;INITIATED_BY_MERCHANT— transaction on the saved card initiated by the merchant;RECURRING_PAYMENT— recurring operation on the saved card;INSTALLMENT— repeated operation on the saved card in accordance with payment schedule for credit repayment.

firstTransaction– JSON-object with transaction identifier info where card was saved. Contains fields:paymentId– unique payment identifier in RSP information system;trnId– unique payment identifier in NSPK information system.

For the two-step payment (default option), the reimbursement is formed only after the order confirmation.

To make one-step payment without the funds holding, include the "flags":["SALE"] parameter in the API request Payment. If you do not pass this parameter, the funds holding for the payment is made and service waits for confirmation of the payment.

Awaiting the customer authentication (3-D Secure)

Example of response with customer authentication requirement

{

"paymentId": "1811",

"billId": "autogenerated-a29ea8c9-f9d9-4a60-87c2-c0c4be9affbc",

"createdDateTime": "2019-08-15T13:28:26+03:00",

"amount": {

"currency": "RUB",

"value": 1.00

},

"capturedAmount": {

"currency": "RUB",

"value": 0.00

},

"refundedAmount": {

"currency": "RUB",

"value": 0.00

},

"paymentMethod": {

"type": "CARD",

"maskedPan": "444444******1049",

"rrn": "123",

"authCode": "181218",

"type": "CARD"

},

"status": {

"value": "WAITING",

"changedDateTime": "2019-08-15T13:28:26+03:00"

},

"requirements" : {

"threeDS" : {

"pareq" : "eJyrrgUAAXUA+Q==",

"acsUrl" : "https://test.paymentgate.ru/acs/auth/start.do"

}

}

}

Redirecting for 3-D Secure authentication

<form name="form" action="{ACSUrl}" method="post" >

<input type="hidden" name="TermUrl" value="{TermUrl}" >

<input type="hidden" name="MD" value="{MD}" >

<input type="hidden" name="PaReq" value="{PaReq}" >

</form>

Finishing customer authentication

POST /partner/payin/v1/sites/test-01/payments/1811/complete HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"threeDS": {

"pares": "eJzVWFevo9iyfu9fMZrzaM0QjWHk3tIiGptgooE3cgabYMKvv3jvTurTc3XOfbkaJMuL...."

}

}

If bank requires 3-D Secure authentication of the customer, the payment response contains the requirements.threeDS JSON-object with fields:

acsUrl— 3-D Secure authentication server URL to redirect to the issuer's confirmation page;pareq— an encrypted 3-D Secure authentication request.

To proceed with additional authentication from the issuer, send a POST form to the 3-D Secure authentication server URL with parameters:

TermUrl— customer redirection URL after successful 3-D Secure authentication;MD— a unique transaction identifier;PaReq— thepareqvalue from the response to the payment request.

To maintain backward compatibility, using 3-D Secure 1.0 or 3-D Secure 2.0 does not affect your integration with the API.

The customer's information is passed to the card payment system. The issuer bank either grants permission to charge funds without authentication (frictionless flow) or decides whether to authenticate with a single-time password (challenge flow). After the authentication is passed, the customer is redirected to TermUrl URL with the encrypted result of the authentication in the PaRes parameter.

To complete the authentication of the customer, pass on the API request Completing customer authentication:

- unique RSP ID;

- payment number (

paymentIdoption) from the response to the payment request; - 3-D Secure verification value (

PaResvalue)

Confirm payment

Notification example

{

"payment":{

"paymentId":"804900", <==paymentId required for 'capture'

"type":"PAYMENT",

"createdDateTime":"2020-11-28T12:58:49+03:00",

"status":{

"value":"SUCCESS",

"changedDateTime":"2020-11-28T12:58:53+03:00"

},

"amount":{

"value":100.00,

"currency":"RUB"

},

"paymentMethod":{

"type":"CARD",

"maskedPan":"444444XXXXXX4444",

"rrn":null,

"authCode":null,

"type":"CARD"

},

"merchantSiteUid":"test-00",

"customer":{

"phone":"75167693659"

},

"gatewayData":{

"type":"ACQUIRING",

"eci":"6",

"authCode":"181218"

},

"billId":"autogenerated-a51d0d2c-6c50-405d-9305-bf1c13a5aecd",

"flags":[]

},

"type":"PAYMENT",

"version":"1"

}

Capture example

PUT /partner/payin/v1/sites/{siteId}/payments/804900/captures/bxwd8096 HTTP/1.1

Accept: application/json

Authorization: Bearer 5c4b25xx93aa435d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

The capture step is required only for two-step payments with holding funds.

To confirm payment:

- Get

paymentIdof the payment:- From notification after successful holding funds.

- From the response to Payment status API request.

- Send API request Confirm payment with received

paymentIdvalue.

Payment token

Using payment token in a payment request

PUT /partner/payin/v1/sites/test-02/payments/1815 HTTP/1.1

Accept: application/json

Authorization: Bearer 7uc4b25xx93xxx5d9cb8cd17480356f9

Content-type: application/json

Host: api.qiwi.com

{

"amount": {

"currency": "RUB",

"value": 2000.00

},

"paymentMethod" : {

"type": "TOKEN",

"paymentToken" : "66aebf5f-098e-4e36-922a-a4107b349a96"

},

"customer": {

"account": "token324"

}

}

The payment tokens are used for charging a customer balance without entering card details or QIWI Wallet number. By default, the use of payment tokens is disabled. Contact your manager in QIWI Support to enable that.

When using payment token for the payment, customer does not have to enter its card data and proceed with 3-D Secure authentication.

The issue of a payment token is described in this section.

To pay for the customer order with its payment token, send the following data in API request Payment:

- API access key;

- payment amount data;

- payment method parameters in

paymentMethodobject:type–TOKEN;paymentToken– payment token string;

- customer identifier in the RSP system for which the payment token was issued, in

customer.accountparameter (without this parameter, you cannot pay with the payment token.); - other information about the payment.

When the customer card was previously tokenized on your side, the following parameters in paymentMethod should be included:

cardTokenPaymentType– parameter for correct processing of transactions in the payment systems. Allowed values:INITIATED_BY_CLIENT— transaction on the saved card initiated by a client;INITIATED_BY_MERCHANT— transaction on the saved card initiated by the merchant;RECURRING_PAYMENT— recurring operation on the saved card;INSTALLMENT— repeated operation on the saved card in accordance with payment schedule for credit repayment.

firstTransaction– JSON-object with transaction identifier info where card was saved. Contains fields:paymentId– unique payment identifier in RSP information system;trnId– unique payment identifier in NSPK information system.

Faster Payments System

Payment protocol supports charging funds from the customer by Faster Payments System (FPS). With FPS, payment can be made to commercial organizations, including QR coded ones.

By default, FPS payment method is turned off. To use this method, contact your manager in QIWI Support.

Receiving QR code

Example of request for FPS payment

{

"amount": {

"value": 100.00,

"currency": "RUB"

},

"qrCode": {

"type": "DYNAMIC",

"ttl": 999,

"image": {

"mediaType": "image/png",

"width": 300,

"height": 300

}

},

"paymentPurpose": "Flower for my girlfriend",

"redirectUrl": "http://someurl.com"

}

Example of response with QR code

{

"qrCodeUid": "Test12",

"amount": {

"currency": "RUB",

"value": "100.00"

},

"qrCode": {

"type": "DYNAMIC",

"ttl": 999,

"image": {

"mediaType": "image/png",

"width": 300,

"height": 300,

"content": "iVBORw0KGgoAAAANSUhEUgAAASwAAAEsCAYAA"

},

"payload": "https://qr.nspk.ru/AD10006M8KH234K782OQM0L13JI31LQDtype=02bank=100000000009&sum=200&cur=RUB&crc=C63A",

"status": "CREATED"

},

"createdOn": "2022-08-11T20:10:32+03:00"

}

When paying with Faster Payment System a customer scans a QR code and receives a payment link to open and make payment in her bank application.

To create a QR code for the payment, send the API request Faster Payment System QR code with specific parameters:

- Unique QR code API request identifier.

qrCodeobject with QR code parameters:qrCode.type—DYNAMIC.qrCode.ttl— code lifetime (minutes). The QR code is deactivated after the period ends. Default value is 72 hours.qrCode.image— QR code image size and type.

amount— payment amount.paymentPurpose— payment details. If it is empty customer bank app displays merchant's store title.

In the response, the JSON object qrCode contains the data of the QR code:

image.content— base64-encoded QR code. After decryption, you get an image to show to the customer.payload— URL-based QR for customer redirection to its bank app.

FPS payment status

When payment status becomes final, the notification will be sent with the corresponding QR code API request identifier in qrCodeUid field. Payment status can be determined with paymentId identifier from the same notification by the API request.

QR code status

Example of response for FPS QR code status request

{

"qrCodeUid": "Test",

"amount": {

"currency": "RUB",

"value": "1.00"

},

"qrCode": {

"type": "DYNAMIC",

"ttl": 999,

"payload": "https://qr.nspk.ru/AD10006M8KH234K782OQM0L13JI31LQDtype=02bank=100000000009&sum=200&cur=RUB&crc=C63A",

"status": "PAYED"

},

"payment": {

"paymentUid": "A22231710446971300200933E625FCB3",

"paymentStatus": "COMPLETED"

},

"createdOn": "2022-08-11T20:10:32+03:00"

}

To get QR code information you can use the Faster Payment System QR Code Status API request. Response contains QR code details including its current status so you can check if it is still a valid one.

FPS token payment

Request body for payment with FPS token

{

"tokenizationAccount": "customer123",

"token": "c5ba4a05-21c9-4a36-af7a-b709b4caa4d6"

}

See details about FPS payment token issue in this section.

Use Payment by FPS token API method with the following parameters:

token— FPS payment token;tokenizationAccount— client identifier for which the token was issued.

Testing operations

See information in this section.

Payment from mobile phone account

Purchases from a mobile phone account occur without entering card data. After merchant initiates payment, customer receives SMS from their mobile network operator. SMS contains the information about corresponding purchase. Customer approves or rejects the payment by the response SMS.

By default, this payment method is turned off. To use this method, contact your manager in QIWI Support.

How to send a payment

Payment example

{

"paymentMethod": {

"type": "MOBILE_COMMERCE",

"phone": "+79111111111"

},

"amount": {

"value": 5900.00,

"currency": "RUB"

},

"flags": [

"SALE"

],

"customer": {

"account": "79111111111",

"email": "test@qiwi.com",

"phone": "79111111111"

}

}

When sending payment, put into paymentMethod object in Payment API request the following data:

type—MOBILE_COMMERCE.phone— phone number, from which to make a payment. Number should be in international format with+sign.

Server Notifications

Notification

POST <callback-path> HTTP/1.1

Accept: application/json

Content-type: application/json

Signature: J4WNfNZd***V5mv2w=

Host: <callback-url>

{

"payment": {

...

},

"type": "PAYMENT",

"version": "1"

}

QIWI server notification is an incoming HTTP POST request. The JSON-formatted notification message in the request body contains payment/invoice data encoded in UTF-8 codepage.

The Protocol supports the following notification types for API events:

PAYMENT— sends when a payment operation is made;CAPTURE— sends when a payment confirmation is made;REFUND— sends when a refund for payment is made;CHECK_CARD— sends when a card verification is made;TOKEN— sends when a Faster Payments System payment token is issued and applied for payment operations.

Specify the notification server address in your Account Profile in Settings section.

To put different notification address for a separate operation, use the following parameters in the API requests:

callbackUrl— in the Payment, Payment confirmation, Refund API requests.customFields.invoice_callback_url— in the Invoice API request.

The URL for notifications should start with https, as notifications are sent by HTTPS to port 443.

The site certificate must be issued by a trusted certification center (e.g. Comodo, Verisign, Thawte, etc.)

To make sure the notification is from QIWI, we recommend you to accept messages only from the following IP addresses belonging to QIWI:

- 79.142.16.0/20

- 195.189.100.0/22

- 91.232.230.0/23

- 91.213.51.0/24

To treat notification as successfully delivered, we need your notification server to respond with HTTP code 200 OK.

Notification Authorization

Notification headers example

POST /qiwi-notify.php HTTP/1.1

Accept: application/json

Content-Type: application/json

Signature: j4wnfnzd***v5mv2w=

Host: example.com

The notification contains a digital signature of the request data which RSP should verify on its side to secure from notification fraud.

The UTF-8 encoded digital signature is placed into HTTP header Signature of the notification message.

To validate the signature, HMAC integrity check with SHA256-hash is used.

Implement the following algorithm to verify notification signature:

-

Join values of some parameters from the notification with the pipe "|" character as a separator. For example:

parameters = {payment.paymentId}|{payment.createdDateTime}|{payment.amount.value}where

{*}– notification parameter value. All values must be converted to UTF-8 encoded string representation.Signature should be verified for those notification fields:

PAYMENTtype:payment.paymentId|payment.createdDateTime|payment.amount.valueREFUNDtype:refund.refundId|refund.createdDateTime|refund.amount.valueCAPTUREtype:capture.captureId|capture.createdDateTime|capture.amount.valueCHECK_CARDtype:checkPaymentMethod.requestUid|checkPaymentMethod.checkOperationDateTOKENtype:token.merchantSiteUid|token.account|token.status.value|token.status.changedDateTime

-

Calculate hash HMAC value with SHA256 algorithm (signature string and secret key should be UTF8-encoded):

hash = HMAC(SHA256, secret, parameters)where:

secret– HMAC hash key. It is the server notification key in Settings section of the Merchant Account Profile.parameters– string from step 1.

-

Compare the notification signature from

SignatureHTTP-header with the result of step 2. If there is no difference, the validation is successful.

Frequency of notification sending

QIWI notification service sorts unsuccessful notifications on the following queues:

- One attempt on waiting 5 seconds

- One attempt on waiting 1 minutes

- Three attempts on waiting 5 minutes

Resend time may be increased.

PAYMENT Notification Format

HEADERS

- Signature: XXX

- Accept: application/json

- Content-type: application/json

PAYMENT notification body

{

"payment": {

"paymentId": "A22170834426031500000733E625FCB3",

"customFields": {},

"type": "PAYMENT",

"createdDateTime": "2022-08-05T11:34:42+03:00",

"status": {

"value": "SUCCESS",

"changedDateTime": "2022-08-05T11:34:44+03:00"

},

"amount": {

"value": 5,

"currency": "RUB"

},

"paymentMethod": {

"type": "SBP",

"phone": "79111112233"

},

"merchantSiteUid": "test-00",

"customer": {

"phone": "0",

"bankAccountNumber": "4081710809561219555",

"bic": "044525974",

"lastName": "IVANOV",

"firstName": "IVAN",

"middleName": "IVANOVICH",

"simpleAddress": "",

"bankMemberId": "100000000008"

},

"billId": "autogenerated-6cd20922-b1d0-4e67-ba61-e2b7310c4006",

"flags": [

"SALE"

]

},

"type": "PAYMENT",

"version": "1"

}

PAYMENT notification body for a split payments

{

"payment": {

"paymentId": "134d707d-fec4-4a84-93f3-781b4f8c24ac",

"customFields": {

"comment": "My comment"

},

"paymentCardInfo": {

"issuingCountry": "643",

"issuingBank": "Unknown",

"paymentSystem": "VISA",

"fundingSource": "UNKNOWN",

"paymentSystemProduct": "Unknown"

},

"type": "PAYMENT",

"createdDateTime": "2021-02-05T11:29:38+03:00",

"status": {

"value": "SUCCESS",

"changedDateTime": "2021-02-05T11:29:39+03:00"

},

"amount": {

"value": 3,

"currency": "RUB"

},

"paymentMethod": {

"type": "TOKEN",

"paymentToken": "1620161e-d498-431b-b006-c52bb78c6bf2",

"maskedPan": "425600******0003",

"cardHolder": "CARD HOLDER",

"cardExpireDate": "11/2022"

},

"merchantSiteUid": "test-00",

"customer": {

"email": "glmgmmxr@qiwi123.com",

"account": "sbderxuftsrt",

"phone": "13387571067",

"country": "yccsnnfjgthu",

"city": "sqdvseezbpzo",

"region": "shbvyjgspjvu"

},

"gatewayData": {

"type": "ACQUIRING",

"authCode": "181218",

"rrn": "123"

},

"billId": "autogenerated-19cf2596-62a8-47f2-8721-b8791e9598d0",

"flags": [],

"paymentSplits": [

{

"type": "MERCHANT_DETAILS",

"siteUid": "Obuc-00",

"splitAmount": {

"value": 2,

"currency": "RUB"

},

"splitCommissions": {

"merchantCms": {

"value": 0.2,

"currency": "RUB"

},

"userCms": null

},

"orderId": "dressesforwhite",

"comment": "Purchase 1"

},

{

"type": "MERCHANT_DETAILS",

"siteUid": "Obuc-01",

"splitAmount": {

"value": 1,

"currency": "RUB"

},

"splitCommissions": {

"merchantCms": {

"value": 0.02,

"currency": "RUB"

},

"userCms": null

},

"orderId": "shoesforvalya",

"comment": "Purchase 2"

}

]

},

"type": "PAYMENT",

"version": "1"

}

| Notification field | Description | Type | When present |

|---|---|---|---|

| payment | Payment information | Object | Always |

| payment. type |

Operation type | String(200) | Always |

| payment. paymentId |

Payment operation identifier in RSP's system | String(200) | Always |

| payment. createdDateTime |

System date of the operation creation | URL-encoded stringYYYY-MM-DDThh:mm:ss |

Always |

| payment. billId |

Corresponding invoice ID for the operation | String(200) | Always |

| payment. qrCodeUid |

QR-code issue operation identifier in RSP's system | String | In case of operation with Faster Payment System |

| payment. amount |

Object | Operation amount data | Always |

| payment. amount. value |

Operation amount rounded down to two decimals | Number(6.2) | Always |

| payment. amount. currency |

Operation currency (Code: Alpha-3 ISO 4217) | String(3) | Always |

| payment. status |

Operation status data | Object | Always |

| payment. status. value |

Operation status value | String | Always |

| payment. status. changedDatetime |

Date of operation status update | URL-encoded stringYYYY-MM-DDThh:mm:ssZ |

Always |

| payment. status. reasonCode |

Rejection reason code | String(200) | In case of operation rejection |

| payment. status. reasonMessage |

Rejection reason description | String(200) | In case of operation rejection |

| payment. status. errorCode |

Error code | Number | In case of error |

| payment. paymentMethod |

Payment method data | Object | Always |

| payment. paymentMethod. type |

Payment method type: CARD — bank card, TOKEN — payment token, SBP — Fast Payments System, QIWI_WALLET — QIWI Wallet balance |

String | Always |

| payment. paymentMethod. paymentToken |

Card payment token | String | When payment token is used for the payment |

| payment. paymentMethod. maskedPan |

Masked card PAN | String | When card or payment token is used for the payment |

| payment. paymentMethod. rrn |

Payment RRN (ISO 8583) | Number | When card or payment token is used for the payment |

| payment. paymentMethod. authCode |

Payment Auth code | Number | When card or payment token is used for the payment |

| payment. paymentMethod. phone |

Phone number linked to the customer's card, or QIWI Wallet number | String | When paying through Fast Payments System, or from QIWI Wallet balance |

| payment. paymentCardInfo |

Card information | Object | Always |

| payment. paymentCardInfo. issuingCountry |

Issuer country code | String(3) | Always |

| payment. paymentCardInfo. issuingBank |

Issuer name | String | Always |

| payment. paymentCardInfo. paymentSystem |

Card's payment system | String | Always |

| payment. paymentCardInfo. fundingSource |

Card's type (debit/credit/..) | String | Always |

| payment. paymentCardInfo. paymentSystemProduct |

Card's category | String | Always |

| payment. merchantSiteUid |

Merchant ID | String | Always |

| payment. customer |

Customer data | Object | Always |

| payment. customer. phone |

Customer phone number | String | Always |

| payment. customer. |

Customer e-mail | String | Always |

| payment. customer. account |

Customer ID in RSP system | String | Always |

| payment. customer. ip |

Customer IP address | String | Always |

| payment. customer. country |

Customer country from address string | String | Always |

| payment. customer. bankAccountNumber |

Payer's bank account number | String | When paying through Fast Payments System |

| payment. customer. bic |

Issuer BIC | String | When paying through Fast Payments System |

| payment. customer. lastName |

Customer's last name | String | When paying through Fast Payments System |

| payment. customer. firstName |

Customer's first name | String | When paying through Fast Payments System |

| payment. customer. middleName |

Customer's middle name | String | When paying through Fast Payments System |

| payment. customer. simpleAddress |

Customer's address | String | When paying through Fast Payments System |

| payment. customer. inn |

Customer's TIN | String | When paying through Fast Payments System |

| payment. customer. bankMemberId |

Customer's bank identifier | String | When paying through Fast Payments System |

| payment. customFields |

Fields with additional information for the operation | Object | Always |

| payment. customFields. cf1 |

Extra field with some information to operation data | String(256) | Always |

| payment. customFields. cf2 |

Extra field with some information to operation data | String(256) | Always |

| payment. customFields. cf3 |

Extra field with some information to operation data | String(256) | Always |

| payment. customFields. cf4 |

Extra field with some information to operation data | String(256) | Always |

| payment. customFields. cf5 |

Extra field with some information to operation data | String(256) | Always |

| payment. flags |

Additional API commands | Array of Strings. Possible elements: SALE, REVERSAL |

Always |

| payment. tokenData |

Payment token data | Object | When payment token issue was requested |

| payment. tokenData. paymentToken |

Card payment token | String | When payment token issue was requested |

| payment. tokenData. expiredDate |

Payment token expiration date. ISO-8601 Date format:YYYY-MM-DDThh:mm:ss±hh:mm |

String | When payment token issue was requested |

| payment. chequeData |

Fiscal receipt description | ChequeData | When data for a fiscal receipt were sent in the operation payload |

| payment. paymentSplits |

Split payments description | Array(Objects) | For split payments |

| payment. paymentSplits. type |

Data type. Always MERCHANT_DETAILS |

String | For split payments |

| payment. paymentSplits. siteUid |

Merchant ID | String | For split payments |

| payment. paymentSplits. splitAmount |

Merchant reimbursement | Object | For split payments |

| payment. paymentSplits. splitAmount. value |

Amount of reimbursement | Number | For split payments |

| payment. paymentSplits. splitAmount. currency |

Text code of reimbursement currency, by ISO | String(3) | For split payments |

| payment. paymentSplits. splitCommissions |

Commission data | Object | For split payments |

| payment. paymentSplits. splitCommissions. merchantCms |

Commission from merchant | Object | For split payments |

| payment. paymentSplits. splitCommissions. merchantCms. value |

Amount of commission | Number | For split payments |

| payment. paymentSplits. splitCommissions. merchantCms. currency |

Text code of commission currency, by ISO | String(3) | For split payments |

| payment. paymentSplits. orderId |

Order number | String | For split payments |

| payment. paymentSplits. comment |

Comment for the order | String | For split payments |

| payment. settlementAmount |

Merchant's settlement data | Object | If payment currency and merchant settlement currency are different |

| payment. settlementAmount. value |

Merchant's settlement amount | Number(6.2) | If payment currency and merchant settlement currency are different |

| payment. settlementAmount. currency |

Merchant's settlement currency identifier (Alpha-3 ISO 4217 code) | String(3) | If payment currency and merchant settlement currency are different |

| type | Notification type (PAYMENT) |

String(200) | Always |

| version | Notification version | String | Always |

CAPTURE Notification Format

HEADERS

- Signature: XXX

- Accept: application/json

- Content-type: application/json

CAPTURE notification body

{

"capture": {

"paymentId": "A22170834426031500000733E625FCB3",

"captureId": "B33180934426031511100733DG332XTQ1",

"customFields": {},

"type": "CAPTURE",

"createdDateTime": "2022-08-06T11:34:42+03:00",

"status": {

"value": "SUCCESS",

"changedDateTime": "2022-08-06T12:55:44+03:00"

},

"amount": {

"value": 5,

"currency": "RUB"

},

"paymentMethod": {

"type": "CARD",

"maskedPan": "54************47",

"cardHolder": null,

"cardExpireDate": "12/2024"

},

"merchantSiteUid": "test-00",

"customer": {},

"billId": "autogenerated-6cd20922-b1d0-4e67-ba61-e2b7310c4006",

"flags": []

},

"type": "CAPTURE",

"version": "1"

}

| Notification field | Description | Type | |

|---|---|---|---|

| capture | Capture information | Object | |

| capture. type |

Operation type | String(200) | |

| capture. paymentId |

Payment operation identifier in RSP's system | String(200) | |

| capture. captureId |

Capture operation identifier in RSP's system | String(200) | |

| capture. createdDateTime |

System date of the operation creation | URL-encoded stringYYYY-MM-DDThh:mm:ss |

|

| capture. amount |

Object | Operation amount data | |

| capture. amount. value |

Operation amount rounded down to two decimals | Number(6.2) | |

| capture. amount. currency |

Operation currency (Code: Alpha-3 ISO 4217) | String(3) | |

| capture. billId |

Corresponding invoice ID for the operation | String(200) | |

| capture. status |

Operation status data | Object | |

| capture. status. value |

Operation status value | String | |

| capture. status. changedDatetime |

Date of operation status update | URL-encoded stringYYYY-MM-DDThh:mm:ssZ |

|

| capture. status. reasonCode |

Rejection reason code | String(200) | |

| capture. status. reasonMessage |

Rejection reason description | String(200) | |

| capture. status. errorCode |

Error code | Number | |

| capture. paymentMethod |

Payment method data | Object | |

| capture. paymentMethod. type |

Payment method type | String | |

| capture. paymentMethod. maskedPan |

Masked card PAN | String | |

| capture. paymentMethod. rrn |

Payment RRN (ISO 8583) | Number | |

| capture. paymentMethod. authCode |

Payment Auth code | Number | |

| capture. merchantSiteUid |

Merchant ID | String | |

| capture. customer |

Customer data | Object | |

| capture. customer. phone |

Customer phone number | String | |

| capture. customer. |

Customer e-mail | String | |

| capture. customer. account |

Customer ID in RSP system | String | |

| capture. customer. ip |

Customer's IP address | String | |

| capture. customer. country |

Customer country from address string | String | |

| capture. customFields |

Fields with additional information for the operation | Object | |

| capture. customFields. cf1 |

Extra field with some information to operation data | String(256) | |

| capture. customFields. cf2 |

Extra field with some information to operation data | String(256) | |

| capture. customFields. cf3 |

Extra field with some information to operation data | String(256) | |

| capture. customFields. cf4 |

Extra field with some information to operation data | String(256) | |

| capture. customFields. cf5 |

Extra field with some information to operation data | String(256) | |

| capture. settlementAmount |

Merchant's settlement data | Object | If payment currency and merchant settlement currency are different |

| capture. settlementAmount. value |

Merchant's settlement amount | Number(6.2) | If payment currency and merchant settlement currency are different |

| capture. settlementAmount. currency |

Merchant's settlement currency identifier (Alpha-3 ISO 4217 code) | String(3) | If payment currency and merchant settlement currency are different |

| capture. flags |

Additional API commands | Array of Strings. Possible elements: SALE, REVERSAL |

|

| type | Notification type (CAPTURE) |

String(200) | |

| version | Notification version | String |

REFUND Notification Format

HEADERS

- Signature: XXX

- Accept: application/json

- Content-type: application/json

REFUND notification body for a split payments refund

{

"refund": {

"paymentId": "A22170834426031500000733E625FCB3",

"refundId": "42f5ca91-965e-4cd0-bb30-3b64d9284048",

"type": "REFUND",

"createdDateTime": "2021-02-05T11:31:40+03:00",

"status": {

"value": "SUCCESS",

"changedDateTime": "2021-02-05T11:31:40+03:00"

},

"amount": {

"value": 3,

"currency": "RUB"

},

"paymentMethod": {

"type": "TOKEN",

"paymentToken": "1620161e-d498-431b-b006-c52bb78c6bf2",

"maskedPan": null,

"cardHolder": null,

"cardExpireDate": null

},

"merchantSiteUid": "test-00",

"customer": {

"email": "glmgmmxr@qiwi123.com",

"account": "sbderxuftsrt",

"phone": "13387571067",

"country": "yccsnnfjgthu",

"city": "sqdvseezbpzo",

"region": "shbvyjgspjvu"

},

"gatewayData": {

"type": "ACQUIRING",

"authCode": "181218",

"rrn": "123"

},

"billId": "autogenerated-19cf2596-62a8-47f2-8721-b8791e9598d0",

"flags": [

"REVERSAL"

],

"refundSplits": [

{

"type": "MERCHANT_DETAILS",

"siteUid": "Obuc-00",

"splitAmount": {

"value": 2,

"currency": "RUB"

},

"splitCommissions": {

"merchantCms": {

"value": 0,

"currency": "RUB"

},

"userCms": null

},

"orderId": "dressesforwhite",

"comment": "Some purchase"

},

{

"type": "MERCHANT_DETAILS",

"siteUid": "Obuc-01",

"splitAmount": {

"value": 1,

"currency": "RUB"

},

"splitCommissions": {

"merchantCms": {

"value": 0.02,

"currency": "RUB"

},

"userCms": null

},

"orderId": "shoesforvalya",

"comment": "Some purchase 2"

}

]

},

"type": "REFUND",

"version": "1"

}

| Notification field | Description | Type | When present |

|---|---|---|---|

| refund | Refund information | Object | Always |

| refund. type |

Operation type | String(200) | Always |

| refund. paymentId |

Original payment operation identifier in RSP's system | String(200) | Always |

| refund. refundId |

Refund operation identifier in RSP's system | String(200) | Always |

| refund. createdDateTime |

System date of the operation creation | URL-encoded stringYYYY-MM-DDThh:mm:ss |

Always |

| refund. amount |

Object | Operation amount data | Always |

| refund. amount. value |

Operation amount rounded down to two decimals | Number(6.2) | Always |

| refund. amount. currency |

Operation currency (Code: Alpha-3 ISO 4217) | String(3) | Always |

| refund. billId |

Corresponding invoice ID for the operation | String(200) | Always |

| refund. status |

Operation status data | Object | Always |

| refund. status. value |

Operation status value | String | Always |

| refund. status. changedDatetime |

Date of operation status update | URL-encoded stringYYYY-MM-DDThh:mm:ssZ |

Always |

| refund. status. reasonCode |

Rejection reason code | String(200) | In case of operation rejection |

| refund. status. reasonMessage |

Rejection reason description | String(200) | In case of operation rejection |

| refund. status. errorCode |

Error code | Number | In case of error |

| refund. paymentMethod |

Payment method data | Object | Always |

| refund. paymentMethod. type |

Payment method type | String | Always |

| refund. paymentMethod. maskedPan |

Masked card PAN | String | IAlways |

| refund. paymentMethod. rrn |

Payment RRN (ISO 8583) | Number | Always |

| refund. paymentMethod. authCode |

Payment Auth code | Number | Always |

| refund. merchantSiteUid |

Merchant ID | String | Always |

| refund. customer |

Customer data | Object | Always |

| refund. customer. phone |

Customer phone number | String | Always |

| refund. customer. |

Customer e-mail | String | Always |

| refund. customer. account |

Customer ID in RSP system | String | Always |

| refund. customer. ip |

Customer IP address | String | Always |

| refund. customer. country |

Customer country from address string | String | Always |

| refund. customFields |

Fields with additional information for the operation | Object | Always |

| refund. customFields. cf1 |

Extra field with some information to operation data | String(256) | Always |

| refund. customFields. cf2 |

Extra field with some information to operation data | String(256) | Always |

| refund. customFields. cf3 |

Extra field with some information to operation data | String(256) | Always |

| refund. customFields. cf4 |

Extra field with some information to operation data | String(256) | Always |

| refund. customFields. cf5 |

Extra field with some information to operation data | String(256) | Always |

| refund. flags |

Additional API commands | Array of Strings. Possible elements: SALE, REVERSAL |

Always |

| refund. chequeData |

Fiscal receipt description | ChequeData | When data for a fiscal receipt were sent in the operation payload |

| refund. refundSplits |

Refund of split payments description | Array(Objects) | For refund split payments |

| refund. refundSplits. type |

Data type. Always MERCHANT_DETAILS |

String | For refund split payments |

| refund. refundSplits. siteUid |

Merchant ID | String | For refund split payments |

| refund. refundSplits. splitAmount |

Data on cancelled reimbursement for the merchant | Object | For refund split payments |

| refund. refundSplits. splitAmount. value |

Amount of cancelled reimbursement | Number | For refund split payments |

| refund. refundSplits. splitAmount. currency |

Text code of cancelled reimbursement currency, by ISO | String(3) | For refund split payments |

| refund. refundSplits. splitCommissions |

Commission data | Object | For refund split payments |

| refund. refundSplits. splitCommissions. merchantCms |

Commission from the merchant | Object | For refund split payments |

| refund. refundSplits. splitCommissions. merchantCms. value |

Commission amount | Number | For refund split payments |

| refund. refundSplits. splitCommissions. merchantCms. currency |

Text code of commission currency, by ISO | String(3) | For refund split payments |

| refund. refundSplits. orderId |

Order number | String | For refund split payments |

| refund. refundSplits. comment |

Comment to the order | String | For refund split payments |

| refund. settlementAmount |

Merchant's settlement data | Object | If payment currency and merchant settlement currency are different |

| refund. settlementAmount. value |

Merchant's settlement amount | Number(6.2) | If payment currency and merchant settlement currency are different |

| refund. settlementAmount. currency |

Merchant's settlement currency identifier (Alpha-3 ISO 4217 code) | String(3) | If payment currency and merchant settlement currency are different |

| type | Notification type (REFUND) |

String(200) | Always |

| version | Notification version | String | Always |

CHECK_CARD Notification Format

HEADERS

- Signature: XXX

- Accept: application/json

- Content-type: application/json

CHECK_CARD notification example

{

"checkPaymentMethod": {

"status": "SUCCESS",

"isValidCard": true,

"threeDsStatus": "PASSED",

"cardInfo": {

"issuingCountry": "RUS",

"issuingBank": "Альфа-банк",

"paymentSystem": "MASTERCARD",

"fundingSource": "PREPAID",

"paymentSystemProduct": "TNW|TNW|Mastercard® New World—Immediate Debit|TNW|Mastercard New World-Immediate Debit"

},

"createdToken": {

"token": "7653465767c78-a979-5bae621db96f",

"name": "54**********47",

"expiredDate": "2022-12-30T00:00:00+03:00",

"account": "acc1"

},

"requestUid": "uuid1-uuid2-uuid3-uuid4",

"paymentMethod": {

"type": "CARD",

"maskedPan": "54************47",

"cardHolder": null,

"cardExpireDate": "12/2022"

},

"checkOperationDate": "2021-08-16T14:15:07+03:00",

"merchantSiteUid": "test-00"

},

"type": "CHECK_CARD",

"version": "1"

}

| Notification field | Description | Type |

|---|---|---|

| checkPaymentMethod | Card verification result | Object |

| checkPaymentMethod. checkOperationDate |

System date of the operation | URL-encoded stringYYYY-MM-DDThh:mm:ssZ |

| checkPaymentMethod. requestUid |

Card verification operation identifier | String(200) |

| checkPaymentMethod. status |

Card verification status | String |

| checkPaymentMethod. isValidCard |

true means card can be charged |

Bool |

| checkPaymentMethod. threeDsStatus |

Information on customer authentication status. Possible values: PASSED (3-D Secure passed), NOT_PASSED (3-D Secure not passed), WITHOUT (3-D Secure not required) |

String |

| checkPaymentMethod. paymentMethod |

Payment method data | Object |

| checkPaymentMethod. paymentMethod. type |

Payment method type | String |

| checkPaymentMethod. paymentMethod. maskedPan |

Masked card PAN | String |

| checkPaymentMethod. paymentMethod. cardExpireDate |

Card expiration date (MM/YY) | String |

| checkPaymentMethod. paymentMethod. cardHolder |

Cardholder name | String |

| checkPaymentMethod. cardInfo |

Card information | Object |

| checkPaymentMethod. cardInfo. issuingCountry |

Issuer country code | String(3) |

| checkPaymentMethod. cardInfo. issuingBank |

Issuer name | String |

| checkPaymentMethod. cardInfo. paymentSystem |

Card's payment system | String |

| checkPaymentMethod. cardInfo. fundingSource |

Card's type (debit/credit/..) | String |

| checkPaymentMethod. cardInfo. paymentSystemProduct |

Card's category | String |

| checkPaymentMethod. createdToken |

Payment token data | Object |

| checkPaymentMethod. createdToken. token |

Card payment token | String |

| checkPaymentMethod. createdToken. name |

Masked card PAN for which payment token issued | String |

| checkPaymentMethod. createdToken. expiredDate |

Payment token expiration date. ISO-8601 Date format:YYYY-MM-DDThh:mm:ss±hh:mm |

String |

| checkPaymentMethod. createdToken. account |

Customer account for which payment token issued | String |

| checkPaymentMethod. merchantSiteUid |

Merchant ID | String |

| type | Notification type | String(200) |

| version | Notification version | String |

TOKEN Notification format

HEADERS

- Signature: XXX

- Accept: application/json

- Content-type: application/json

Notification about successful FPS token issue

{

"token": {

"status": {

"value": "CREATED",

"changedDateTime": "2023-01-01T10:00:00+03:00"

},

"merchantSiteUid": "test-00",

"account": "test",

"value": "d28a4ff8-548d-4536-927d-fc01123bebbf",

"expiredDate": "2029-01-01T10:00:00+03:00",

"tokenizationSource": {

"type": "QR_CODE",

"uid": "100220001"

},

"bankMemberId": "100000000008"

},

"type": "TOKEN",

"version": "1"

}

Notification on unsuccessful FPS token issue

{

"token": {

"status": {

"value": "REJECTED",

"changedDateTime": "2023-01-01T10:00:00+03:00"

},

"merchantSiteUid": "test-00",

"account": "test",

"tokenizationSource": {

"type": "QR_CODE",

"uid": "14012000011"

}

},

"type": "TOKEN",

"version": "1"

}

| Notification field | Description | Type | When present |

|---|---|---|---|

| token | Token data | Object | Always |

| token. status |

Operation status data | Object | Always |

| token. status. value |

Status value | String | Always |

| token. status. changedDateTime |

Status change data | URL-encoded stringYYYY-MM-DDThh:mm:ssZ |

Always |

| token. status. rejectReason |

Rejection reason | String | When operation is rejected |

| token. merchantSiteUid |

Merchant site ID | String | Always |

| token. account |

Client identifier specified in payment token request | String | Always |

| token. value |

Payment token value | String | When operation is successful |

| token. expiredDate |

Payment token expiration date. Date format is according to ISO-8601: YYYY-MM-DDThh:mm:ss±hh:mm |

String | When operation is successful |

| token. tokenizationSource |

Tokenization source data | Object | Always |

| token. tokenizationSource. type |

Tokenization source type | String | Always |

| token. tokenizationSource. uid |

Tokenization source ID | String | Always |

| token. bankMemberId |

Client's bank identifier | String | В случае успешной операции |

| type | Notification type | String | Always |